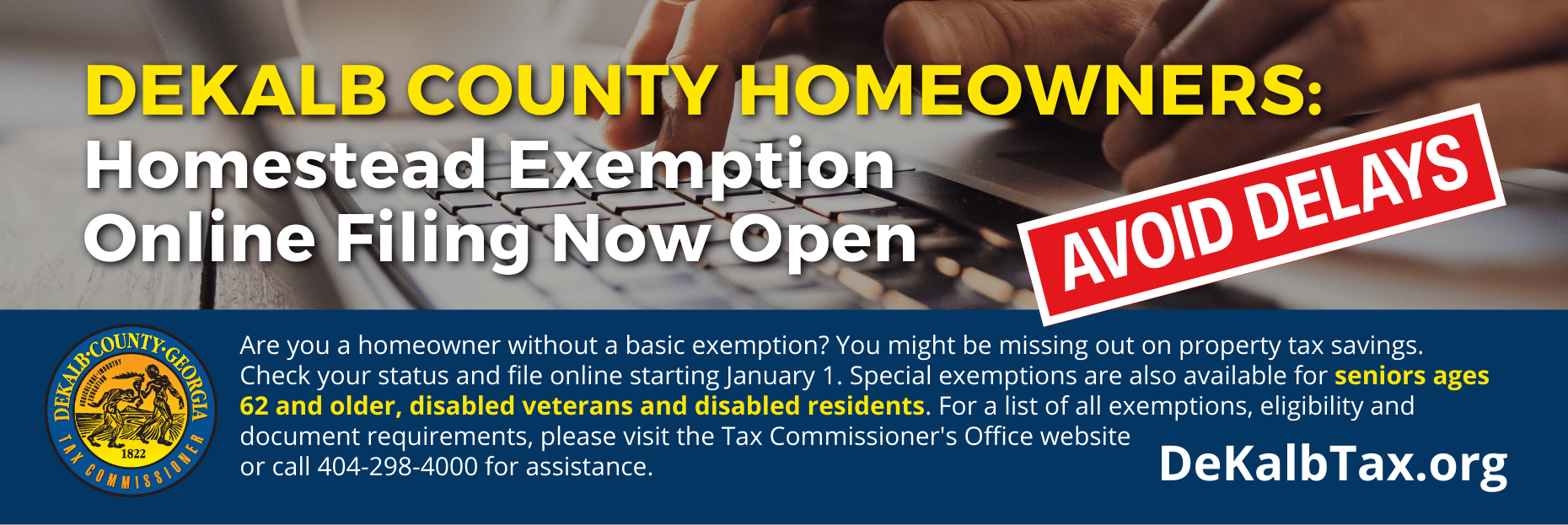

DEKALB COUNTY, GA– DeKalb County homestead exemption applications are due by April 1 for the current tax year. Letters were recently mailed to homeowners who may be eligible for a senior exemption, a property assessment freeze, or a basic homestead exemption for the current tax year.

“We’re encouraging homeowners, especially seniors ages 62 and older, to check their exemption status,” said Tax Commissioner Irvin Johnson. “Changes to income limits that were passed in the legislature went into effect in 2024, allowing more seniors to meet eligibility requirements for special exemptions.”

Exemptions provide a reduction in annual property taxes and are available to individuals who own and occupy the home in the county, including the City of Atlanta portion in DeKalb. Special exemptions are additional tax savings for eligible seniors, disabled residents, disabled veterans or surviving spouse, surviving spouse of a U.S. service member, and surviving spouse of a peace officer or firefighter. Age and income requirements must be met to qualify for senior exemptions.

Individuals applying for the first time must own and occupy the home as their primary residence as of Jan. 1, 2025, have all vehicles registered in DeKalb County at the primary residence, have a Georgia ID or Georgia driver’s license showing residency at the property, file income taxes from the property, and not have a homestead exemption anywhere else. Applications received after April 1 will be processed for the following year.

Applications can be filed online from January until the April 1; and in person year-round at all office locations during business hours. Appointments are highly encouraged and can be scheduled online at DeKalbTax.org/appointments to reduce wait times.

All exemption applications, including property assessment freezes, must be filed by the April 1 deadline to determine eligibility. Applications received after April 1 will be processed for the following year. Once an exemption is granted, it automatically renews as long as the owner resides at the property, or until a different exemption is filed and granted.

How to check your exemption status:

- Access your property information at publicaccess.dekalbtax.org.

- Look for the “Exemption Codes” field. If there is no code, look for the green button in the “Owner Information” area on the page and click “Apply for homestead exemption”.

- If you’re a senior ages 62+ by January 1, and have an H1 exemption, you may apply online for a special exemption.

- If your exemption status indicates an H4, H9 or A6, no further action is required.

Residents in DeKalb who owned their homes prior to 2007 with an existing homestead exemption may need to apply separately for a property assessment freeze. The benefit of a “freeze” is to help offset future increases in property value.

![Validate my RSS feed [Valid RSS]](https://web.archive.org/web/20240108205913im_/https://ocgnews.com/wp-content/uploads/2022/07/valid-rss-rogers.png)