Annual tax bills will be mailed mid-August

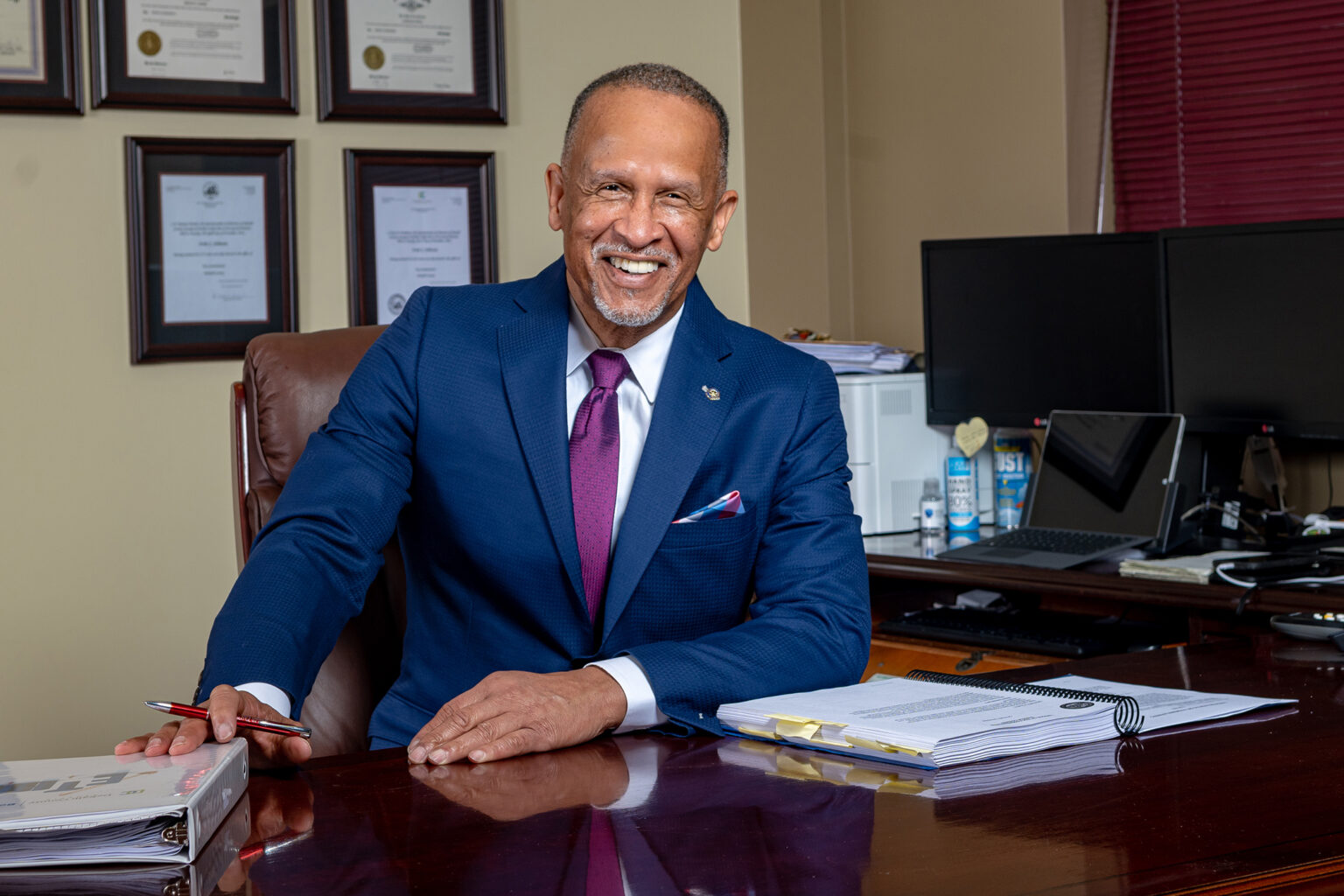

DECATUR, GA– DeKalb County Tax Commissioner Irvin J. Johnson is reminding homeowners that assessment notices are not tax bills. Property owners are currently receiving their annual assessment notices ,which are estimates of potential tax bills.

“It’s important to understand that this office works collaboratively with the county’s Property Appraisal & Assessment Department to provide a seamless billing and collection process for ad valorem taxes in DeKalb,” said Johnson. “Homeowners should initiate their assessment appeal with the assessor’s office before the July 15 deadline. Actual tax bills are expected to be mailed in August, following the successful approval of the county’s tax digest.”

If a homeowner disagrees with the current valuation, appeals must be filed with the assessor’s office within 45 days of the mailing date on their assessment notice. Instructions to file an appeal are included in the notice, which must be filed before the deadline. Property owners who have not received an assessment notice should contact the assessor’s office.

“While assessment notices serve as an estimate of your tax bill, this year’s bill is expected to be higher for homeowners. The state’s one-time homeowner tax relief credit for the 2023 tax year will not be included in this year’s billing. Any other rate increases for 2024 will be included in the annual tax bill, not the assessment notice,” said Johnson.

Each year, property tax bills are computed based on millage rates set by the governing authorities, the fair market values determined by the Property Appraisal & Assessment Department, and the assessment valuation of 40%. The bills also reflect any credits (deductions) that may result from EHOST (Equalized Homestead Options Sales Tax), and basic, senior, or special homestead exemptions provided by state and local law.

The Tax Commissioner’s Office is responsible for property tax billing and collection of taxes based on assessments. Tax bills are expected to be mailed mid-August following the successful approval of the county’s tax digest by the Georgia Department of Revenue.

The digest is an official listing of county property and its assessed value. The Tax Commissioner’s Office, in conjunction with the DeKalb County Board of Commissioners, CEO, Tax Assessor’s Office (Property Appraisal), GIS, Board of Education, city governments, and county administration, work together to prepare the tax digest.

For questions and concerns regarding annual assessment notices, please contact the Property Appraisal office at 404-371-0841 or visit https://www.dekalbcountyga.gov/property-appraisal/welcome for more information.

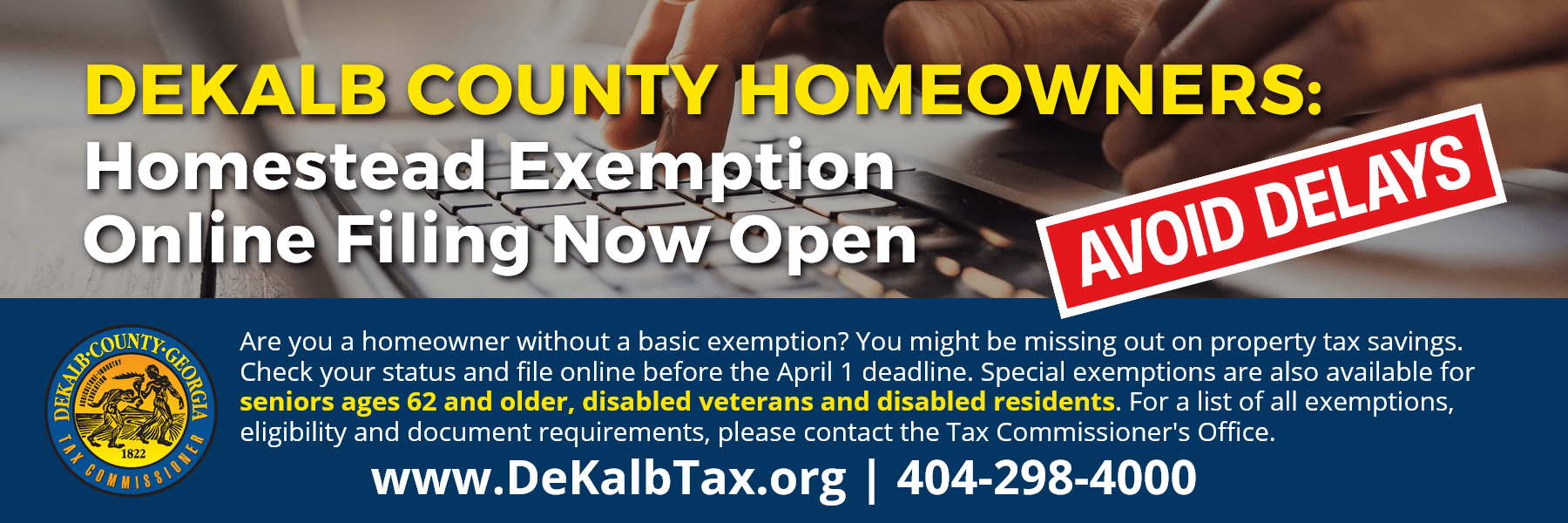

Questions regarding homestead exemptions and exemption status may be directed to the Tax Commissioner’s Office by phone at 404-298-4000 or email proptax@dekalbcountyga.gov. The deadline to file for an exemption was April 1.

PROPERTY TAX REMINDERS

- DeKalb County property tax bills will be mailed beginning mid-August.

- Tax bills reflect a computed assessment based on multiple elements: millage rates set by the governing authorities, the fair market values determined by the county’s Property Appraisal & Assessment Department, and the assessment valuation of 40%.

- Taxpayers should be aware that in any tax year your tax bill could be higher due to an increase in the fair market value of your property but can be offset by tax savings (EHOSTand exemptions). The deadline to apply for homestead exemptions was April 1.

- Questions about property appraised values should be directed to the county’sProperty Appraisal Department by calling 404-371-0841.

- Questions about homestead exemptions and exemption status may be directed to theTax Commissioner’s Officeby phone at 404-298-4000 or email proptax@dekalbcountyga.gov.

![Validate my RSS feed [Valid RSS]](https://web.archive.org/web/20240108205913im_/https://ocgnews.com/wp-content/uploads/2022/07/valid-rss-rogers.png)