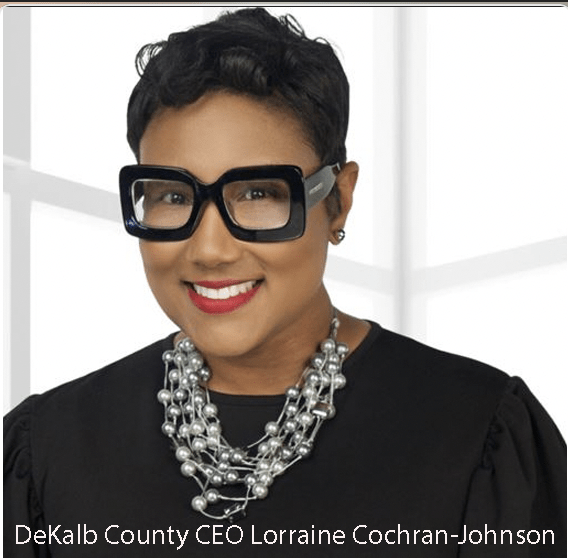

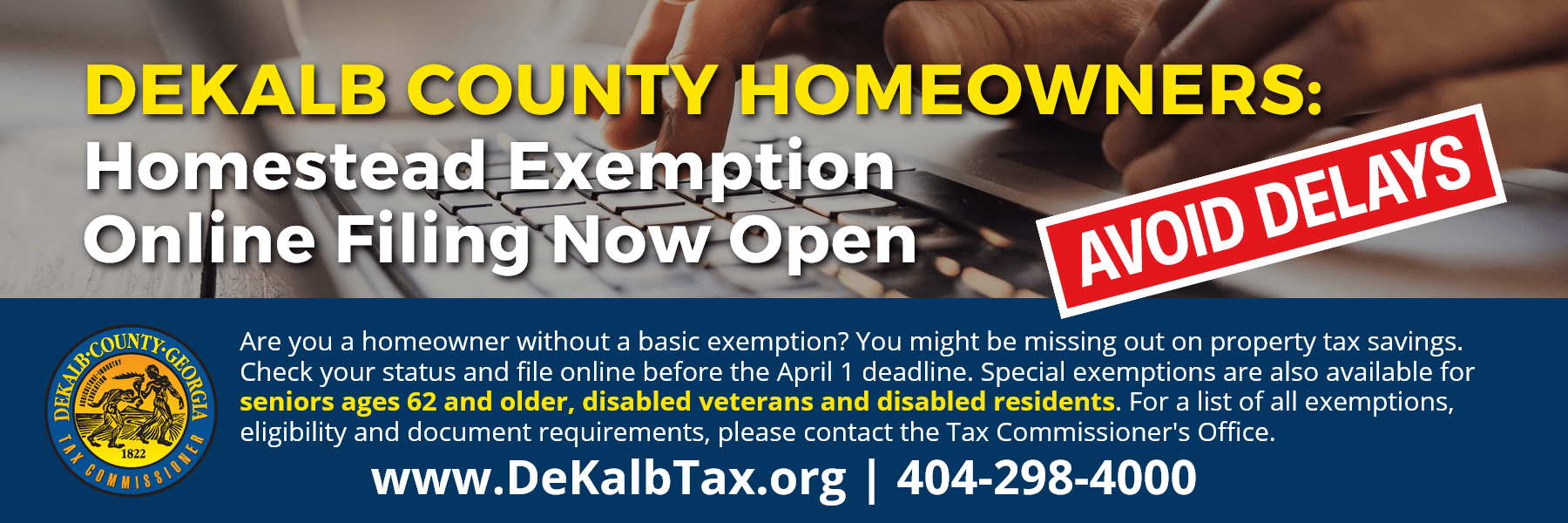

DEKALB COUNTY, GA- DeKalb County CEO Lorraine Cochran-Johnson has announced that the county’s Equalized Homestead Option Sales Tax (EHOST) credit for 2025 will provide $206.3 million in residential property tax relief for those with homestead exemptions.

The EHOST credit is included in the proposed resolution to adopt the 2025 millage rates that is being considered by the Board of Commissioners.

“DeKalb County is the only county in the state with a one penny sales tax that’s dedicated 100 percent to property tax relief, “ said CEO Cochran-Johnson. ”All residents with a homestead exemption will receive the EHOST credit. Taxpayers have until July 14 to apply for a homestead exemption.”

For a home with a fair market value of:

- $450,000 savings are $424.23.

- $300,000 savings are $275.24.

For a table with the estimated tax savings for various residential valuations visit: https://www.dekalbcountyga.gov/sites/default/files/users/user3568/Estimated%202025%20Property%20Tax%20Savings.pdf

Distribution of the tax credit follows

- $193.5 million will be applied to the countywide millage rates, County Operations (General Fund) and Hospital

- $12.8 million will applied to other millage rates levied by municipalities or other county millage rates

- The additional EHOST tax relief will be distributed on a proportional basis to the cities and unincorporated DeKalb areas based on the gross homestead tax digest.

![Validate my RSS feed [Valid RSS]](https://web.archive.org/web/20240108205913im_/https://ocgnews.com/wp-content/uploads/2022/07/valid-rss-rogers.png)