DEKALB COUNTY, GA– Following the successful review and approval of the county’s 2025 tax digest by the Georgia Department of Revenue on Friday, Aug. 1, the DeKalb County Tax Commissioner’s Office will mail more than 250,000 tax bills to property owners beginning Aug. 15. Bills for City of Atlanta properties in DeKalb will be mailed later.

“Each year, this office along with the DeKalb County Board of Commissioners, CEO, Tax Assessor’s Office (Property Appraisal), GIS, Boards of Education, city governments, and county administration, work together to prepare the county’s tax digest,” said Tax Commissioner Irvin Johnson. “Now my office can officially move forward with the responsibility of collecting county taxes.”

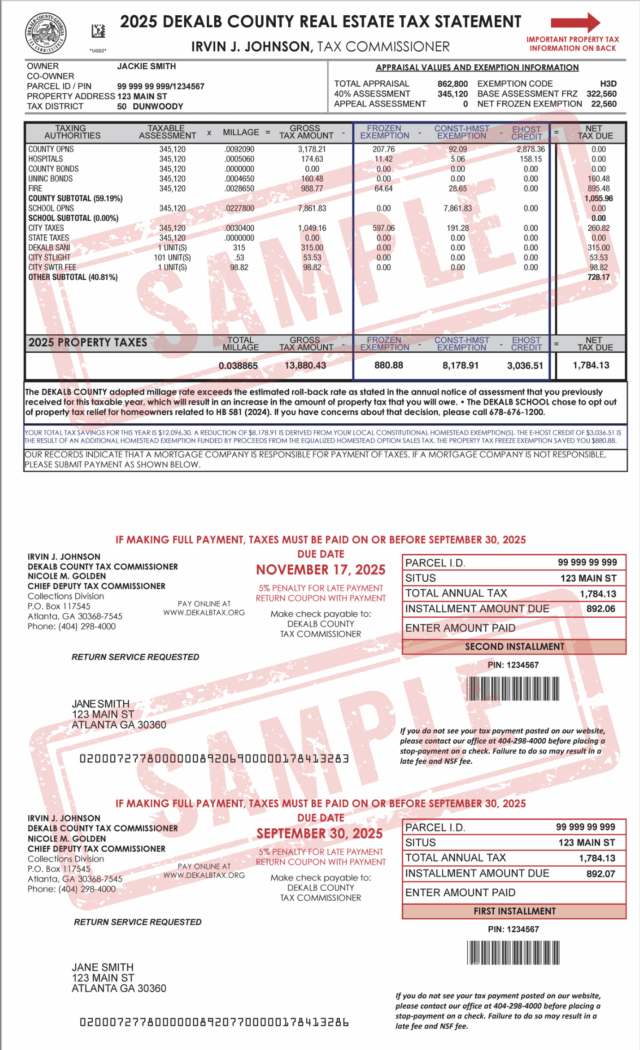

The tax commissioner’s office is responsible for billing, collecting and disbursing county taxes. Each tax bill indicates how tax funds are distributed within the county. Bills display the breakdown of collected taxes for the county, including the county’s general fund, fire and police services, along with cities and school board. Generally, the school board receives a majority percentage followed by the county and cities. This year, the office is set to collect approximately $1.8 billion in revenue.

Each year, property tax bills are computed based on millage rates set by the governing authorities, the fair market values determined by the Property Appraisal & Assessment Department and the assessment valuation of 40%. The bills also reflect any credits (deductions) that may result from EHOST and homestead exemptions provided by state and local law. Any other rate increases for 2025 will be included in the bill.

Property owners are encouraged to sign up for e-billing notifications to avoid mail delivery issues.

To opt in, access your property information at publicaccess.dekalbtax.org and click the “Sign up for E-Alert” button. The system is currently offline and will be available on Aug. 4.

Questions regarding property values should be directed to the county’s Property Appraisal Department at 404-371-0841. The deadline to appeal values was July 18 for real estate property; July 24 for personal property.

To contact the Tax Commissioner’s Office about tax payments and homestead exemptions, call 404-298-4000 or email proptax@dekalbcountyga.gov.

![Validate my RSS feed [Valid RSS]](https://web.archive.org/web/20240108205913im_/https://ocgnews.com/wp-content/uploads/2022/07/valid-rss-rogers.png)