DECATUR, GA – The DeKalb County Tax Commissioner’s Office recently mailed homeowners information regarding senior homestead exemptions for the 2024 tax year. Seniors ages 62 and older are encouraged to check their exemption status online at DeKalbTax.org or call 404-298-4000 for assistance.

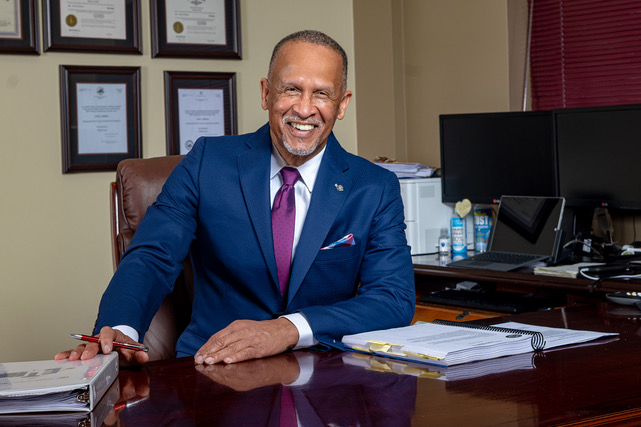

“Changes to income limits that were passed in the legislature last year now allow more seniors to meet eligibility requirements for special exemptions. This was made possible by the collaborative efforts of this Office, the Board of Commissioners, the DeKalb Delegation of Legislators, and DeKalb voters,” said DeKalb County Tax Commissioner Irvin Johnson.

A homestead exemption significantly reduces the amount of annual property taxes homeowners owe on their legal residence. Special exemptions are additional tax savings for eligible senior citizens ages 62 and older, disabled veterans and disabled residents. Age and income requirements must be met to qualify for all senior exemptions.

Homeowners may apply online for basic and special exemptions now through the April 1 deadline. Seniors, and disabled residents and veterans, may still file in person or submit documents by drop box.

Applicants who are filing for a special exemption must have an existing homestead exemption on the primary residence to qualify for a special homestead exemption. Additional requirements include copies of the previous year’s federal and state income tax returns, any Social Security Form 1099, proof of age and/or proof of 100 percent total and permanent disability.

Applications are accepted throughout the year; however, current year exemption applications are only accepted from Jan. 1 through April 1. Applications received after the April 1 deadline will be processed for the following year.

To apply online for special homestead exemptions, or a basic exemption, please visit the DeKalb County Tax Commissioner’s website dekalbtax.org/file-homestead-exemption. To apply in person, appointments can be made online at dekalbtax.org/appointments.

![Validate my RSS feed [Valid RSS]](https://web.archive.org/web/20240108205913im_/https://ocgnews.com/wp-content/uploads/2022/07/valid-rss-rogers.png)