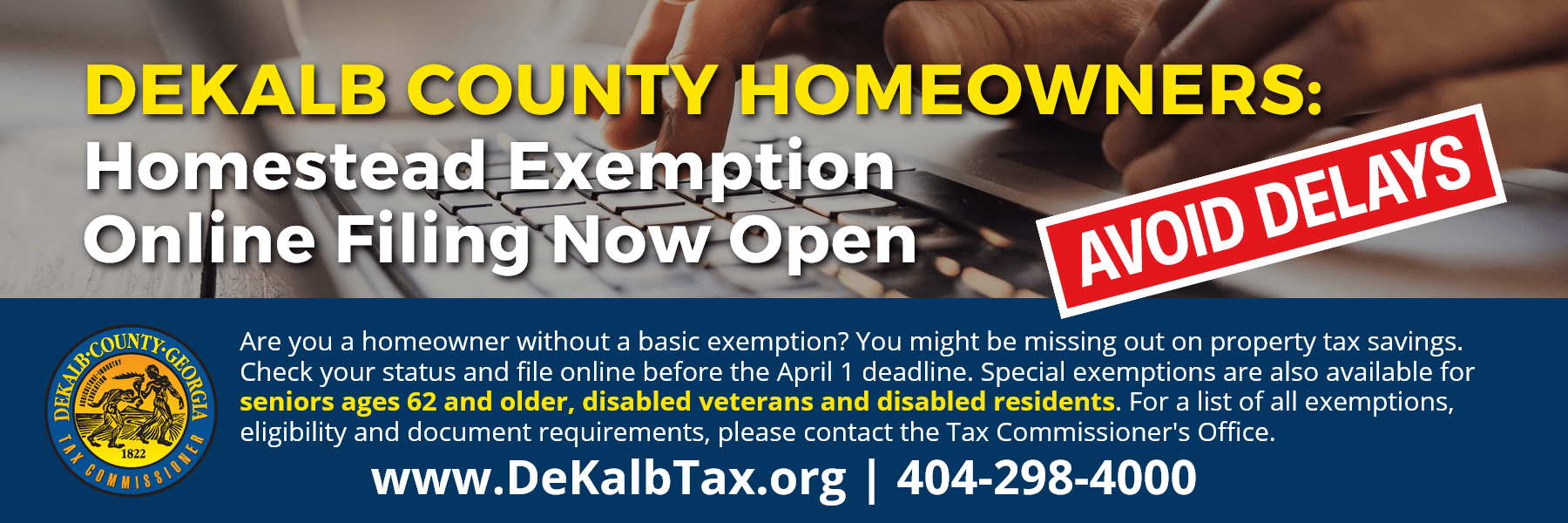

Many DeKalb County property owners who qualified for the homestead exemption received lower tax bills in the mail this week.

“DeKalb has delivered on providing tax relief to county property owners,” said DeKalb County CEO Michael Thurmond. “Thanks to the passage of two historic measures in November, the county is revolutionizing the process of extending tax relief and improved services to DeKalb citizens.”

Tax bills mailed to county property owners included a new column indicating cuts based on the EHOST. The column shows a dollar amount of the Equalized Homestead Option Sales Tax (EHOST) credit for each eligible millage rate and the amount deducted from county property taxes.

For the next six years, DeKalb County homeowners will receive an estimated $110 million annually in property tax relief. The $660 million tax cut is the result of the passage of two measures in November 2017—EHOST and the Special Purpose Local Option Sales Tax (SPLOST).

The following table shows the amount of the 2017 HOST credit compared to the 2018 EHOST credit based on a home with a fair market value of $250,000 and the basic homestead exemption. For information about the property tax bills, visit www.dekalbcountyga.gov/taxcommissioner.

![Validate my RSS feed [Valid RSS]](https://web.archive.org/web/20240108205913im_/https://ocgnews.com/wp-content/uploads/2022/07/valid-rss-rogers.png)