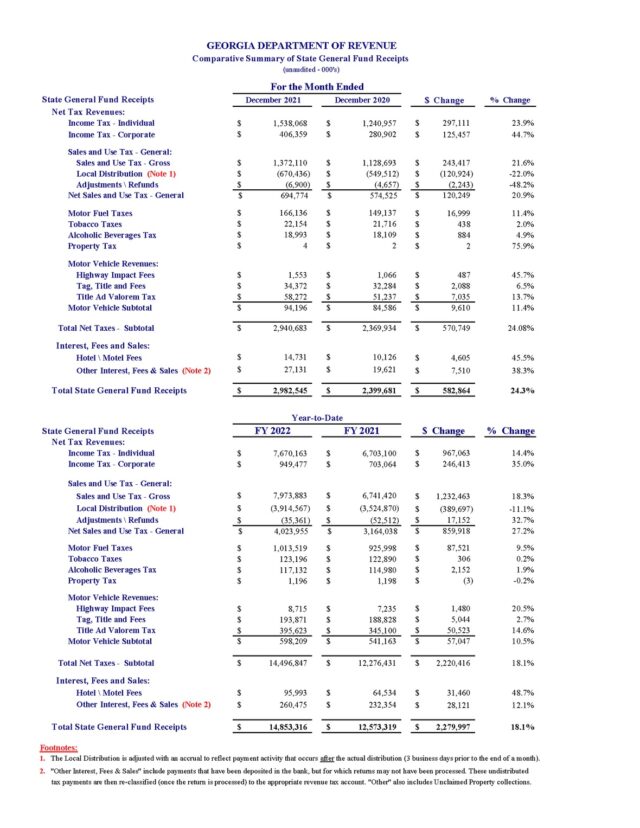

ATLANTA – The State of Georgia’s net tax collections in December totaled $2.98 billion, for an increase of $582.9 million, or 24.3 percent, compared to December 2020 when net tax collections totaled $2.40 billion. Year-to-date, net tax revenue collections totaled $14.85 billion, for an increase of $2.28 billion, or 18.1 percent, over FY 2021 after six months, according to the Georgia Department of Revenue. The changes within the following tax categories account for December’s overall net tax revenue increase, latest statistics show: Individual Income Tax: Individual Income Tax collections for December increased by $297.1 million, or 23.9 percent, compared to December 2020 when net Individual Tax revenues totaled $1.24 billion. The following notable components within Individual Income Tax combine for the net increase: • Individual Income Tax refunds issued (net of voided checks) decreased by $13.4 million or -24.6 percent Sales and Use Tax: Gross Sales and Use Tax collections totaled $1.37 billion, for an increase of $243.4 million, or 21.6 percent, over last year’s total of nearly $1.13 billion. Net Sales and Use Tax for the month increased by roughly $120.2 million, or 20.9 percent, compared to last year, when net Sales Tax revenue totaled $574.5 million. The adjusted Sales Tax distribution to local governments totaled $670.4 million, for an increase of $120.9 million, or 22 percent, over FY 2021. Lastly, Sales Tax refunds increased by $2.2 million, or 48.2 percent compared to FY 2021. Corporate Income Tax: Net Corporate Income Tax collections increased by $125.5 million, or 44.7 percent, up from FY 2021 when net Corporate Tax revenues totaled $280.9 million in December. The following notable components within Corporate Income Tax make up the net increase: • Corporate Tax refunds issued (net of voided checks) decreased by $5.1 million or -21.4 percent Motor Fuel Taxes: Motor Fuel Tax collections for the month increased by $17 million, or 11.4 percent, over last year’s December total of $149.1 million. Motor Vehicle – Tag & Title Fees: Motor Vehicle Tag & Title Fee collections for December increased by $2.1 million, or 6.5 percent, compared to FY 2021 when Motor Vehicle fees totaled $32.3 million. Title ad Valorem Tax (TAVT) collections increased by roughly $7 million, or 13.7 percent, compared to last year’s total of $51.2 million. Source: Office of Gov. Brian Kemp, Georgia Department of Revenue

|

Georgia’s December net tax revenues up 24.3 percent

0Related Posts

Add A Comment

![Validate my RSS feed [Valid RSS]](https://web.archive.org/web/20240108205913im_/https://ocgnews.com/wp-content/uploads/2022/07/valid-rss-rogers.png)