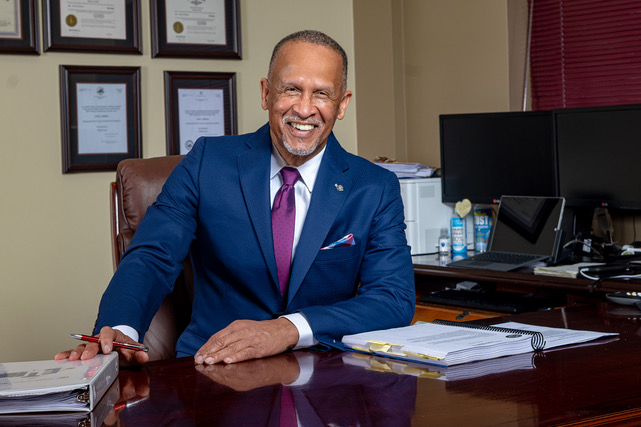

DECATUR GA– DeKalb County Tax Commissioner Irvin J. Johnson is urging DeKalb homeowners to beware of businesses offering tax-saving assistance for a fee. Johnson said that a better option for homeowners is to file an assessment appeal and/or apply for a homestead exemption themselves. These do-it-yourself filings save homeowners time and money, he said.

“During property tax season, my office receives calls from concerned homeowners regarding information from businesses offering to file an assessment appeal or a homestead exemption for a fee,” said Johnson. “Property owners should be aware of schemes targeting seniors and unsuspecting homeowners, potentially costing them their hard-earned money for services that can be performed themselves at no cost. Here at the tax office, homestead exemptions can be filed online at DeKalbTax.org.”

DeKalb property owners who recently received their annual notice of assessment are encouraged to carefully review their notice as soon as possible. Instructions for filing an appeal by the July 10 deadline are included on the notice. The appeal process is also available on the county’s Property Appraisal & Assessment Department website. While the assessment notices serve as an estimate, the actual tax bill may be higher or lower and are mailed from the Tax Commissioner’s Office annually around mid-August.

For questions and concerns regarding annual assessment notices and the appeal process, call the Property Appraisal office at 404-371-0841 or visithttps://www.dekalbcountyga.gov/property-appraisal/contact-us. Questions regarding homestead exemptions and exemption status may be directed to the Tax Commissioner’s Office by phone at 404-298-4000 or emailproptax@dekalbcountyga.gov. The deadline to file for an exemption was April 1.

“During property tax season, my office receives calls from concerned homeowners regarding information from businesses offering to file an assessment appeal or a homestead exemption for a fee,” said Johnson. “Property owners should be aware of schemes targeting seniors and unsuspecting homeowners, potentially costing them their hard-earned money for services that can be performed themselves at no cost. Here at the tax office, homestead exemptions can be filed online at DeKalbTax.org.”

DeKalb property owners who recently received their annual notice of assessment are encouraged to carefully review their notice as soon as possible. Instructions for filing an appeal by the July 10 deadline are included on the notice. The appeal process is also available on the county’s Property Appraisal & Assessment Department website. While the assessment notices serve as an estimate, the actual tax bill may be higher or lower and are mailed from the Tax Commissioner’s Office annually around mid-August.

For questions and concerns regarding annual assessment notices and the appeal process, call the Property Appraisal office at 404-371-0841 or visithttps://www.dekalbcountyga.gov/property-appraisal/contact-us. Questions regarding homestead exemptions and exemption status may be directed to the Tax Commissioner’s Office by phone at 404-298-4000 or emailproptax@dekalbcountyga.gov. The deadline to file for an exemption was April 1.

Post Views: 3,582

![Validate my RSS feed [Valid RSS]](https://web.archive.org/web/20240108205913im_/https://ocgnews.com/wp-content/uploads/2022/07/valid-rss-rogers.png)